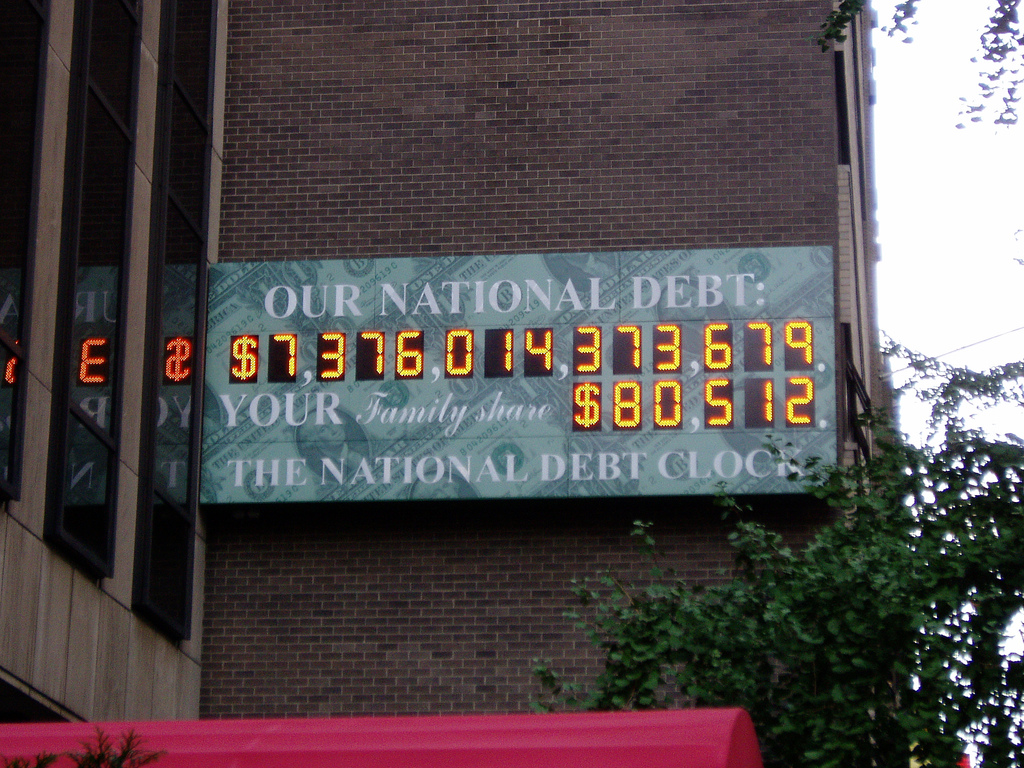

But now the situation is changing. In 2017, interest expenses on servicing the federal debt amounted to $ 263 billion. This is 6.6% of all government spending and 1.4% of GDP, which is much less than the average over the past 50 years. However, the budget deficit and national debt are growing along with interest rates and inflation. In October, the Ministry of Finance has already announced that allocations for interest payments increased by 20% in the 2018 fiscal year (ended in September). By 2028, according to the forecast of the Congressional Budget Office, interest payments will grow to $ 915 billion, which will be equal to 13% of all expenses and 3.1% of GDP.

The following milestones will be covered on the way to these indicators, the CBO estimates: in 2020 the government will spend more on debt servicing than on the Medicaid program of medical assistance to the poor; in 2023 - more than on defense; in 2025 - more than all non-defense budget financing programs, including allocations for the judicial system and infrastructure, health care and education, national parks and scientific research.

Overall, debt will rise from 78% of GDP at the end of this year to 96.2% in 2028, the CBO predicts. Meanwhile, the current figure is already the highest after the end of the Second World War. In the next five years, approximately 70% of federal debt will expire, and they will need to be refinanced at higher rates. The base rate of the Fed now stands at 2-2.25% (and the Board of Governors forecasts four more increases in the coming year), whereas from the end of 2008 to the end of 2015 it remained at the level of 0-0.25%. President Donald Trump has said several times that Fed Chairman Jerome Powell was tightening monetary policy too quickly. “I would like to see the rates low and pay off the debt. And when he continues to raise interest rates, this cannot be done,” Trump said in an interview with The Wall Street Journal in October.

But even with low rates, the US has no chance of reducing debt. The Ministry of Finance plans to issue in 2018 treasury bonds and bills worth twice as much as in 2017. It needs to finance the budget deficit, which revenues are growing slowly due to taxes reduced by Trump and the agreement reached this year by Democrats and Republicans two years of government spending. Then it exceeded the $ 300 billion limit set by law in 2011, when, due to the growing budget deficit, S&P lowered the US credit rating.

By next September, Congress will have to decide whether to extend the agreement on the increase in costs, and then what to do with the income tax reduction initiated by Trump, which will expire in 2025.

“We have already encountered such problems, and they have been resolved,” says Dean Baker, co-director of the Center for Economic and Policy Research. In the early 1990s, when interest expenses were high and growing further, President George Bush Sr. agreed with the Democrats to raise taxes on the rich. This move angered Republican party members and undermined his chances of reelection for a second term. And Bill Clinton, who had become next President, did not implement the program of fiscal stimulation with which he went to the polls. Thanks to these measures, the budget deficit in the late 1990s. was replaced by a surplus.

source: wsj.com

The following milestones will be covered on the way to these indicators, the CBO estimates: in 2020 the government will spend more on debt servicing than on the Medicaid program of medical assistance to the poor; in 2023 - more than on defense; in 2025 - more than all non-defense budget financing programs, including allocations for the judicial system and infrastructure, health care and education, national parks and scientific research.

Overall, debt will rise from 78% of GDP at the end of this year to 96.2% in 2028, the CBO predicts. Meanwhile, the current figure is already the highest after the end of the Second World War. In the next five years, approximately 70% of federal debt will expire, and they will need to be refinanced at higher rates. The base rate of the Fed now stands at 2-2.25% (and the Board of Governors forecasts four more increases in the coming year), whereas from the end of 2008 to the end of 2015 it remained at the level of 0-0.25%. President Donald Trump has said several times that Fed Chairman Jerome Powell was tightening monetary policy too quickly. “I would like to see the rates low and pay off the debt. And when he continues to raise interest rates, this cannot be done,” Trump said in an interview with The Wall Street Journal in October.

But even with low rates, the US has no chance of reducing debt. The Ministry of Finance plans to issue in 2018 treasury bonds and bills worth twice as much as in 2017. It needs to finance the budget deficit, which revenues are growing slowly due to taxes reduced by Trump and the agreement reached this year by Democrats and Republicans two years of government spending. Then it exceeded the $ 300 billion limit set by law in 2011, when, due to the growing budget deficit, S&P lowered the US credit rating.

By next September, Congress will have to decide whether to extend the agreement on the increase in costs, and then what to do with the income tax reduction initiated by Trump, which will expire in 2025.

“We have already encountered such problems, and they have been resolved,” says Dean Baker, co-director of the Center for Economic and Policy Research. In the early 1990s, when interest expenses were high and growing further, President George Bush Sr. agreed with the Democrats to raise taxes on the rich. This move angered Republican party members and undermined his chances of reelection for a second term. And Bill Clinton, who had become next President, did not implement the program of fiscal stimulation with which he went to the polls. Thanks to these measures, the budget deficit in the late 1990s. was replaced by a surplus.

source: wsj.com