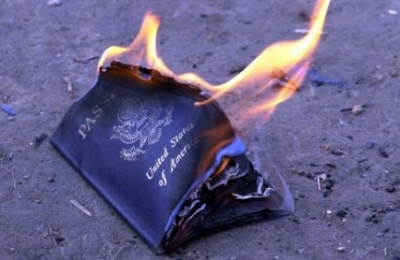

Throughout its history, America has been a country of immigrants. Millions of people from all over the world left their homes to begin a new life in the United States. Now, however, many American passport has lost its appeal. According to the IRS, in the first quarter of this year abandoned the nationality of a record number of Americans.

The agency Bloomberg has estimated that in the first quarter of 2015, more than 1.3 thousand people gave back their passports, that is, almost 20% more than in the first quarter of last year. For the whole of 2014 more than 3.4 thousand people gave up the citizenship.

According to reports, about 6 million Americans live outside the country. Meanwhile, the United States, the only country from participants of the Organization for Economic Cooperation and Development, collects taxes from its citizens regardless of their place of residence.

Experts believe that many Americans decide to renounce citizenship including the fact that American law has become more demanding financial reporting and taxation for non-residents.

It all started with the fact that in 2007 the American employee of Swiss bank UBS Bradley Birkenfeld told US authorities about how he helped American citizens open secret Swiss accounts to evade taxes. Birkenfeld was sentenced to 40 months in a US prison, UBS paid $ 780 million fine. The story dealt a crushing blow to the principle of the Swiss banks’ confidentiality: UBS handed data on about 4,700 accounts over to the authorities. After the incident, foreign banks have become wary of dealing with Americans - and they, in turn, now prefer to give up the citizenship of their country to avoid taxes.

Unlike most countries in the world, US’ taxes are applied to all income, regardless of where a citizen lives, or where the income was received. The appointment procedure of tax collection becomes so difficult and complicated for expats that they are forced to pay high fees for accountants and lawyers. Especially it strikes Americans living abroad who are made to spend thousands of dollars on preparing relatively simple tax returns.

The law on foreign accounts for tax reporting, for example, requires a permanent disclosure of foreign assets, and banks hand over the information about their US clients. Thus, States are trying to control and turn into profit every cent.

The government's efforts are primarily aimed at combating tax evasion, especially in the large Swiss banks. However, this system strikes 7.6 million Americans living abroad. A number of foreign banks have rushed to abandon its American customers in order not to come into conflict with the services of the United States, and also to avoid a large fine.

Some Americans rush to change nationality, fleeing high taxes. For example, Facebook co-founder Eduardo Saverin returned the US passport couple of years ago what exasperated US lawmakers. "We simply cannot afford letting ultra-riches live by their own rules," - then said Sen. Bob Casey. Saverin became a citizen of Singapore, as reported by the media, just because of low taxes.

source: bloomberg.com

The agency Bloomberg has estimated that in the first quarter of 2015, more than 1.3 thousand people gave back their passports, that is, almost 20% more than in the first quarter of last year. For the whole of 2014 more than 3.4 thousand people gave up the citizenship.

According to reports, about 6 million Americans live outside the country. Meanwhile, the United States, the only country from participants of the Organization for Economic Cooperation and Development, collects taxes from its citizens regardless of their place of residence.

Experts believe that many Americans decide to renounce citizenship including the fact that American law has become more demanding financial reporting and taxation for non-residents.

It all started with the fact that in 2007 the American employee of Swiss bank UBS Bradley Birkenfeld told US authorities about how he helped American citizens open secret Swiss accounts to evade taxes. Birkenfeld was sentenced to 40 months in a US prison, UBS paid $ 780 million fine. The story dealt a crushing blow to the principle of the Swiss banks’ confidentiality: UBS handed data on about 4,700 accounts over to the authorities. After the incident, foreign banks have become wary of dealing with Americans - and they, in turn, now prefer to give up the citizenship of their country to avoid taxes.

Unlike most countries in the world, US’ taxes are applied to all income, regardless of where a citizen lives, or where the income was received. The appointment procedure of tax collection becomes so difficult and complicated for expats that they are forced to pay high fees for accountants and lawyers. Especially it strikes Americans living abroad who are made to spend thousands of dollars on preparing relatively simple tax returns.

The law on foreign accounts for tax reporting, for example, requires a permanent disclosure of foreign assets, and banks hand over the information about their US clients. Thus, States are trying to control and turn into profit every cent.

The government's efforts are primarily aimed at combating tax evasion, especially in the large Swiss banks. However, this system strikes 7.6 million Americans living abroad. A number of foreign banks have rushed to abandon its American customers in order not to come into conflict with the services of the United States, and also to avoid a large fine.

Some Americans rush to change nationality, fleeing high taxes. For example, Facebook co-founder Eduardo Saverin returned the US passport couple of years ago what exasperated US lawmakers. "We simply cannot afford letting ultra-riches live by their own rules," - then said Sen. Bob Casey. Saverin became a citizen of Singapore, as reported by the media, just because of low taxes.

source: bloomberg.com