The net long position in WTI futures at Nymex rose by 27 thousand, to 423 thousand - a maximum of 2 months. Producers continue to get rid of "shorts", making their common position the most "bullish" since 2015.

Meanwhile, attention shifts to the events in Venezuela. Today, the US will consider the issue of imposing new sanctions on the Venezuelan oil and gas sector, according to the Wall Street Journal. This will happen on the background of Venezuelan elections for the National Constituent Assembly. The latter is a new political institution that will allow President of Venezuela, Nicolas Maduro, to change the constitution. There are no representatives of the opposition among the candidates for the National Assembly.

However, as the WSJ notes, there is mention of a full-scale ban on the import of Venezuelan oil and oil products to the US. The list of possible restrictions is quite broad: from personal sanctions on officials to banning the national oil company of Venezuela PDVSA from making transactions in US dollars.

By the way, earlier the States have already imposed sanctions on this Latin American country, namely on vice-president of Venezuela, eight members of the Supreme Court and a number of military and government officials in February and May 2017. Besides, last week the US imposed sanctions on 13 high-ranking officials, accusing them of corruption, violation of human rights and undermining of democracy in the South American country. However, on Friday, Vice President Mike Pence promised a new "strong and rapid economic action" if the vote in the National Constituent Assembly continues.

The potential disruption of oil supplies from Venezuela could lead to a sharp increase in oil prices - by $ 5-6, according to analysts at Barclays. More expensive oil, of course, will positively affect activities of American oil shale companies, which will be able to produce even more hydrocarbons. Yet, this will create an excess of oil and lead to a fall in profitability of refineries, which will accordingly reduce demand.

Today, the US WTI blend opened with growth: the price per barrel exceeded $ 50, but then went lower again.

Venezuela produces about 2.3 million barrels of oil and LNG per day, which is about 2% of the world oil market. Venezuelan heavy mixture Orinoco is consumed by oil refineries around the world; these supplies are particularly important for refineries in the US. Venezuela is the third largest exporter of oil in the United States (750,000 barrels per day), behind Canada (3.2 million barrels per day) and Saudi Arabia (1.1 million barrels per day).

About half of exports (1.8 million barrels per day) is delivered to OECD countries, most of the remaining supplies are sent to Asia.

In the near future, a full-fledged civil war can begin in Venezuela. Meanwhile, the US State Department ordered the family members of American diplomats to leave Venezuela.

Also, all employees of the US Embassy in Caracas are allowed to evacuate voluntary. Washington took this step because of "social unrest, violent crimes, as well as widespread shortage of food and medicine." But the riots and the social crisis in the country have been observed since April, so the real reason is different.

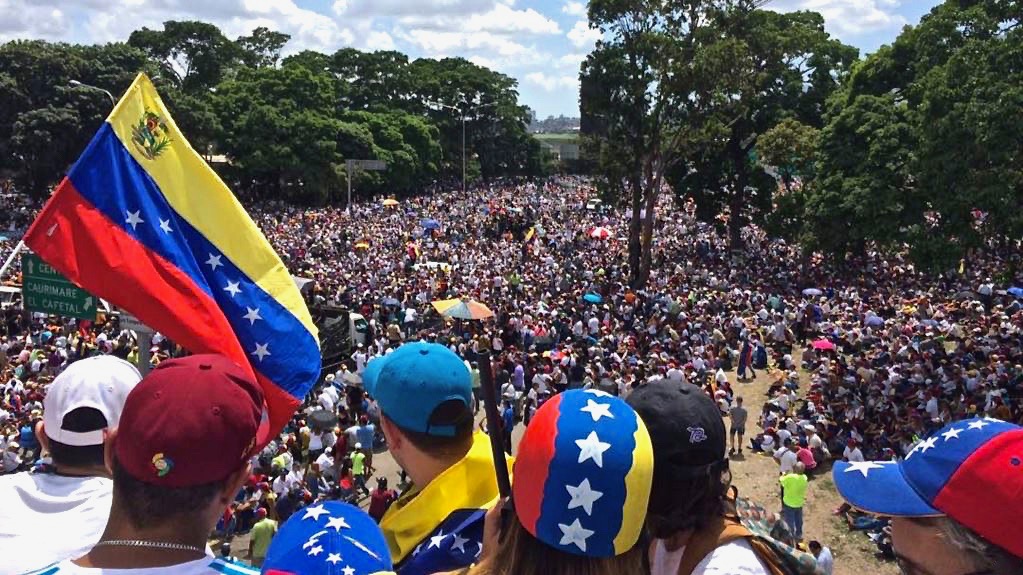

Meanwhile, the Venezuelan government imposed a ban on street protests before the elections to the National Constituent Assembly. This is a direct challenge to opposition leaders who planned mass demonstrations against the elections. The ban announced on Thursday will be effective from Friday, July 28, to Tuesday, August 1, Interior Minister Nestor Reverol noted.

According to him, all those who are more or less involved in the violation of the electoral process will be imprisoned for 5 to 10 years.

All this is happening in Venezuela in the midst of an economic and political crisis, because of which protests in the streets have been raging for months.

source: wsj.com, bloomberg.com

Meanwhile, attention shifts to the events in Venezuela. Today, the US will consider the issue of imposing new sanctions on the Venezuelan oil and gas sector, according to the Wall Street Journal. This will happen on the background of Venezuelan elections for the National Constituent Assembly. The latter is a new political institution that will allow President of Venezuela, Nicolas Maduro, to change the constitution. There are no representatives of the opposition among the candidates for the National Assembly.

However, as the WSJ notes, there is mention of a full-scale ban on the import of Venezuelan oil and oil products to the US. The list of possible restrictions is quite broad: from personal sanctions on officials to banning the national oil company of Venezuela PDVSA from making transactions in US dollars.

By the way, earlier the States have already imposed sanctions on this Latin American country, namely on vice-president of Venezuela, eight members of the Supreme Court and a number of military and government officials in February and May 2017. Besides, last week the US imposed sanctions on 13 high-ranking officials, accusing them of corruption, violation of human rights and undermining of democracy in the South American country. However, on Friday, Vice President Mike Pence promised a new "strong and rapid economic action" if the vote in the National Constituent Assembly continues.

The potential disruption of oil supplies from Venezuela could lead to a sharp increase in oil prices - by $ 5-6, according to analysts at Barclays. More expensive oil, of course, will positively affect activities of American oil shale companies, which will be able to produce even more hydrocarbons. Yet, this will create an excess of oil and lead to a fall in profitability of refineries, which will accordingly reduce demand.

Today, the US WTI blend opened with growth: the price per barrel exceeded $ 50, but then went lower again.

Venezuela produces about 2.3 million barrels of oil and LNG per day, which is about 2% of the world oil market. Venezuelan heavy mixture Orinoco is consumed by oil refineries around the world; these supplies are particularly important for refineries in the US. Venezuela is the third largest exporter of oil in the United States (750,000 barrels per day), behind Canada (3.2 million barrels per day) and Saudi Arabia (1.1 million barrels per day).

About half of exports (1.8 million barrels per day) is delivered to OECD countries, most of the remaining supplies are sent to Asia.

In the near future, a full-fledged civil war can begin in Venezuela. Meanwhile, the US State Department ordered the family members of American diplomats to leave Venezuela.

Also, all employees of the US Embassy in Caracas are allowed to evacuate voluntary. Washington took this step because of "social unrest, violent crimes, as well as widespread shortage of food and medicine." But the riots and the social crisis in the country have been observed since April, so the real reason is different.

Meanwhile, the Venezuelan government imposed a ban on street protests before the elections to the National Constituent Assembly. This is a direct challenge to opposition leaders who planned mass demonstrations against the elections. The ban announced on Thursday will be effective from Friday, July 28, to Tuesday, August 1, Interior Minister Nestor Reverol noted.

According to him, all those who are more or less involved in the violation of the electoral process will be imprisoned for 5 to 10 years.

All this is happening in Venezuela in the midst of an economic and political crisis, because of which protests in the streets have been raging for months.

source: wsj.com, bloomberg.com