The entire amount will be paid in shares, and WPX shareholders will receive 0.52 Devon shares per share. Thus, the current Devon shareholders will own a 57% stake in the new company, and WPX shareholders will hold the remaining 43%. The deal is expected to be completed in early 2021.

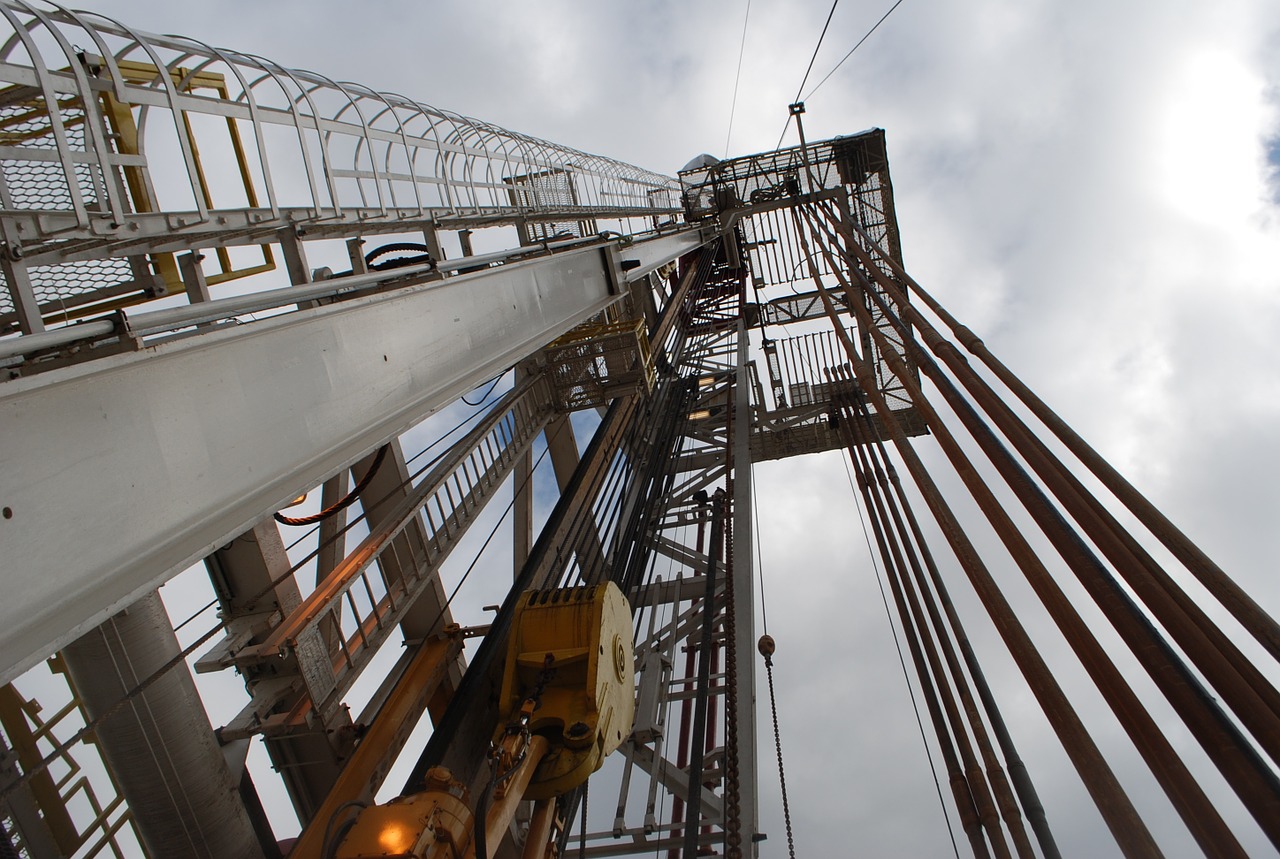

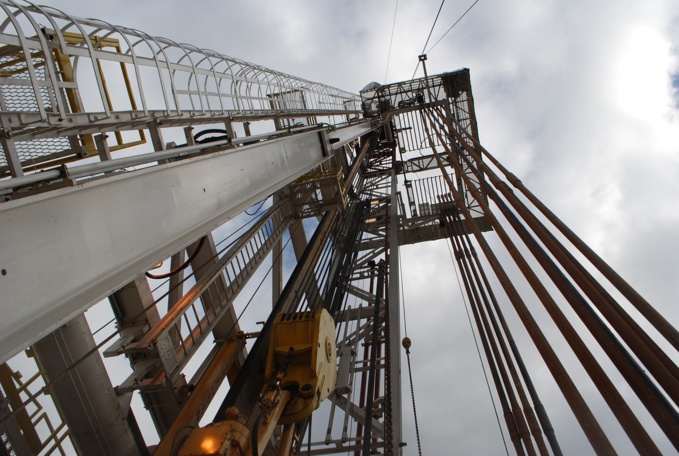

American shale companies are going through difficult times in the face of falling oil prices, given that the cost of producing such oil in the United States is quite high and profitable only when prices are high enough. The merger could help the companies lower costs in these conditions: according to a statement by Devon Energy and WPX, they hope to save $ 575 million by the end of next year thanks to the synergies from the merger. The combined company will produce 277,000 barrels of oil per day.

In July, it became known that the energy corporation Chevron bought the independent oil and gas producer Noble Energy for $ 13 billion. The current merger is different in that both parties to the deal are independent oil and gas companies.

source: bloomberg.com

American shale companies are going through difficult times in the face of falling oil prices, given that the cost of producing such oil in the United States is quite high and profitable only when prices are high enough. The merger could help the companies lower costs in these conditions: according to a statement by Devon Energy and WPX, they hope to save $ 575 million by the end of next year thanks to the synergies from the merger. The combined company will produce 277,000 barrels of oil per day.

In July, it became known that the energy corporation Chevron bought the independent oil and gas producer Noble Energy for $ 13 billion. The current merger is different in that both parties to the deal are independent oil and gas companies.

source: bloomberg.com