Thestrategist.media – 05 June 2015 – According to the reports of AO World, there has been a “pre-tax loss” for an entire year, which amounts to “£2.9m”. Consequently, “trading” in the United Kingdom continues to be “challenging”.

“AO World” is a domestic “appliance retailer” which deals in online transactions. The said company had published a report on “profit warning” sometimes during the month of February which took into consideration all the expectations, revised all the possibilities of the results. However, at the end of financial year, in March the yearly revenue amounted to “£477m”, which turned out to be twenty four percent higher than the estimated line of “revised expectations”.

As per the company’s present status, it informed that the targets were “on track” so far, meeting accurately the plans in the present financial year. AO World had “stunned the City” in the month of February this year, as the said company began to ‘float’ on the exchange stock market. Consequently, the valuation of the said company was determined as an impressive sum of “£1.2bn” as “a market capitalization”. Nevertheless, the afore-mentioned ‘stunning’ amount brought in a profit of only “less than £8m” to AO World.

On the chief executive officer of AO World, Mr John Robert’s words:

“AO World” is a domestic “appliance retailer” which deals in online transactions. The said company had published a report on “profit warning” sometimes during the month of February which took into consideration all the expectations, revised all the possibilities of the results. However, at the end of financial year, in March the yearly revenue amounted to “£477m”, which turned out to be twenty four percent higher than the estimated line of “revised expectations”.

As per the company’s present status, it informed that the targets were “on track” so far, meeting accurately the plans in the present financial year. AO World had “stunned the City” in the month of February this year, as the said company began to ‘float’ on the exchange stock market. Consequently, the valuation of the said company was determined as an impressive sum of “£1.2bn” as “a market capitalization”. Nevertheless, the afore-mentioned ‘stunning’ amount brought in a profit of only “less than £8m” to AO World.

On the chief executive officer of AO World, Mr John Robert’s words:

"Despite missing our financial expectations for the year, we have continued to take market share in the UK".

Moreover, the C.E.O, Mr. Robert, has also other reasons to make merry as he mentions that the “progress” of his “German business”, which he launched sometimes in the month of last October, added to the quotient of encouragement for him. According to the news released by the AO World firm, the company stated a slow sale “in the final quarter of the year”. The sluggish pace in this regard had “become apparent” to the company’s dismay lest it failed to “maintain the year-on-year growth” which was advertised by the “publicity surrounding its float”.

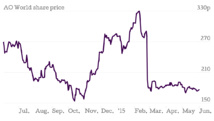

In fact, the shares in the said firm’s possession dropped down steeply followed by the profit warning statement which was issued in the month of February. At present, the trading rates for these shares have reached “about 176p”, continuing to remain under the expected “258p” price of “flotation”.

References:

http://www.bbc.com/news/business-32970666