Selfie introduction is intended to ensure safety when making payments - the system is able to recognize the face of the account holder. Jack Ma reckons that the solution will be part of proprietary payment system Alipay and will be available to all users already in 2017.

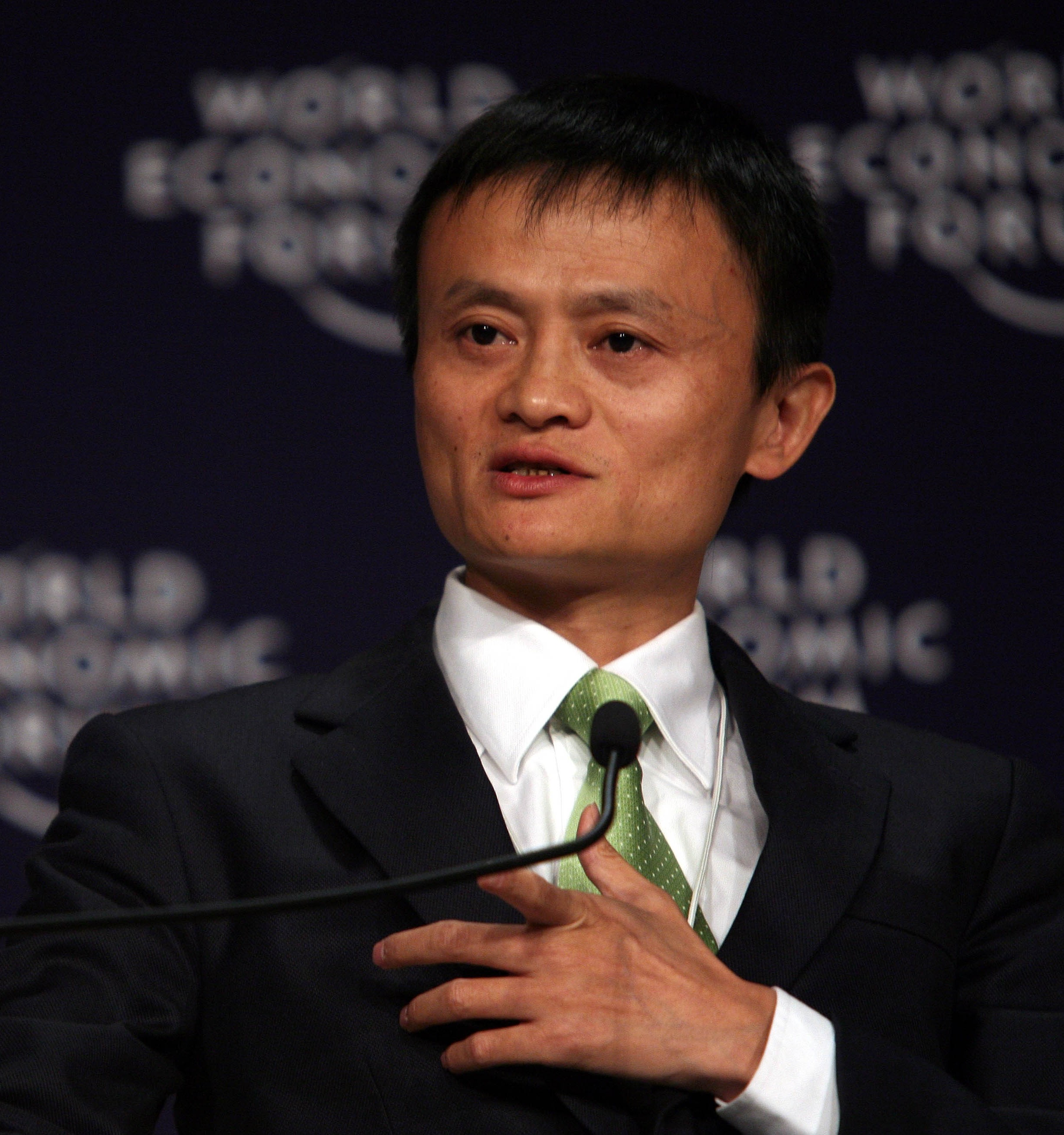

- I want to take this opportunity to show a little innovation that we have developed ... Online payments are always a headache. You forget your password, worried about security. Today we'll show you the new technology, how people in the future will be making purchases on the Internet, - said Jack Ma, one of the richest people in China, in a speech at CeBIT and made the purchase in his online store paying for it with the help of a selfie taken with his smartphone.

The proposed method is another variation of simplifying the procedure of purchase. While other companies are testing biometric scanners to identify the owner, which entails the need to install sensors in gadgets users, the Chinese company Alibaba decided to use the function that already exists in any smartphone.

Let us recall that the initial public offering (IPO) of Chinese Internet giant Alibaba Group Holding Ltd. was the largest in history after the underwriting banks decided to fully exercise the option Greenshoe, reported Financial Times. After the sale of Alibaba’s additional packages placement volume increased to $ 25 billion from the original $ 21.8 billion.

Alibaba’s shares at the end of the first trading session on the NYSE on Friday rose to $ 93.89, what is 38% compared to the price of accommodation. Debut trading of Alibaba securities started on Friday with a delay of unprecedented 2.5 hours – several times the stock exchange changed the starting price benchmark for investors in the direction of increasing.

Capitalization of Alibaba eventually reached $ 231.4 billion, exceeding the market value of the social network Facebook, the online retailer Amazon and the bank JPMorgan Chase. The previous leader in terms of IPO was Agricultural Bank of China - $ 22 billion in 2010, and the threshold IPO at $ 20 billion stepped over only three other companies: Chinese bank ICBC, the insurer AIA Group and automotive group GM. All the top three largest IPO now consists of Chinese companies.

Among the underwriters IPO Alibaba are Credit Suisse, Deutsche Bank, Goldman Sachs, JPMorgan Chase, Morgan Stanley and Citigroup.

Alibaba owns China's largest e-commerce platform, bringing together buyers and sellers, and providing them with various services. 80% of the turnover of e-commerce in the country accounts for the company, around 280 million in the country people use its services. Decision-making in the company is controlled by group of 30 partners. The annual turnover of Alibaba is about $ 300 billion, annual revenue - $ 8.46 billion. In April - June this year the company achieved operating income of $ 1.1 billion, up 42% of the total figure of US Amazon.com and eBay.

The company's founder Jack Ma became the richest man in China with a fortune of $ 21.9 billion, from the data Bloomberg Billionaires Index.

- I do not want to disappoint shareholders, I want to make sure that they are making money, said Ma to CNBC.com , adding that most of all he is worried about the happiness of customers.

- I want to take this opportunity to show a little innovation that we have developed ... Online payments are always a headache. You forget your password, worried about security. Today we'll show you the new technology, how people in the future will be making purchases on the Internet, - said Jack Ma, one of the richest people in China, in a speech at CeBIT and made the purchase in his online store paying for it with the help of a selfie taken with his smartphone.

The proposed method is another variation of simplifying the procedure of purchase. While other companies are testing biometric scanners to identify the owner, which entails the need to install sensors in gadgets users, the Chinese company Alibaba decided to use the function that already exists in any smartphone.

Let us recall that the initial public offering (IPO) of Chinese Internet giant Alibaba Group Holding Ltd. was the largest in history after the underwriting banks decided to fully exercise the option Greenshoe, reported Financial Times. After the sale of Alibaba’s additional packages placement volume increased to $ 25 billion from the original $ 21.8 billion.

Alibaba’s shares at the end of the first trading session on the NYSE on Friday rose to $ 93.89, what is 38% compared to the price of accommodation. Debut trading of Alibaba securities started on Friday with a delay of unprecedented 2.5 hours – several times the stock exchange changed the starting price benchmark for investors in the direction of increasing.

Capitalization of Alibaba eventually reached $ 231.4 billion, exceeding the market value of the social network Facebook, the online retailer Amazon and the bank JPMorgan Chase. The previous leader in terms of IPO was Agricultural Bank of China - $ 22 billion in 2010, and the threshold IPO at $ 20 billion stepped over only three other companies: Chinese bank ICBC, the insurer AIA Group and automotive group GM. All the top three largest IPO now consists of Chinese companies.

Among the underwriters IPO Alibaba are Credit Suisse, Deutsche Bank, Goldman Sachs, JPMorgan Chase, Morgan Stanley and Citigroup.

Alibaba owns China's largest e-commerce platform, bringing together buyers and sellers, and providing them with various services. 80% of the turnover of e-commerce in the country accounts for the company, around 280 million in the country people use its services. Decision-making in the company is controlled by group of 30 partners. The annual turnover of Alibaba is about $ 300 billion, annual revenue - $ 8.46 billion. In April - June this year the company achieved operating income of $ 1.1 billion, up 42% of the total figure of US Amazon.com and eBay.

The company's founder Jack Ma became the richest man in China with a fortune of $ 21.9 billion, from the data Bloomberg Billionaires Index.

- I do not want to disappoint shareholders, I want to make sure that they are making money, said Ma to CNBC.com , adding that most of all he is worried about the happiness of customers.