Companies & CEOs

Goldman's Head to get $ 284 million-worth golden parachute - 01/25/2017

Goldman Sachs’s President Gary Cohn, whom the US president Donald Trump offered to head the National Economic Council, will receive $ 284 million after leaving the bank, Bloomberg reported. To help Cohn avoid conflicts of interest on his new position, the bank’s management decided to accelerate transfer of 96,572 shares to Cohn in accordance with an earlier decision to grant him compensation in...

Apple demands $ 1 billion from Qualcomm - 01/24/2017

In the US, Apple filed a $ 1 billion-worth lawsuit against its computer chips supplier Qualcomm. The smartphones developer claims that its supplier went beyond all bounds and violated antitrust laws, inflating prices of goods. Thus, the supplier refused to return to Apple surplus payment in the amount of $ 1 billion. Now, the companies are waiting for court proceedings. According to CNBC...

Uber to pay $ 20 million for misleading drivers in the US - 01/20/2017

Uber will pay $ 20 million to settle lawsuit of the US Federal Trade Commission (FTC). The latter is claiming that the company misinformed its drivers about their likely earnings, CNN Money reports. According to the FTC, Uber has been making false, misleading or unsubstantiated claims about earnings of drivers and car financing program. Uber claimed that average annual income of a driver in New...

Alibaba is now one of Olympic Sponsors - 01/19/2017

Chinese e-commerce company Alibaba has become the main sponsor of the Olympic Games by signing a deal with the International Olympic Committee (IOC). The contract expires in 2028, informed both parties of the agreement on Thursday. Alibaba, which has now become official partner of the Games in the field of e-commerce and cloud services, will join 12 other major companies-sponsors, including...

Toshiba shares go through the floor thanks to nuclear writedown reports - 01/19/2017

Shares of Japanese company Toshiba at trading on Thursday, 19 January, fell down by 26 percent after reports about losses amounting to more than $ 4.4 billion (500 billion yen). The losses relate to division that produces equipment for nuclear power plants. According to the agency, this collapse of quotations was the most significant since 1974. The company has applied for financial assistance...

Etihad refuses equity stake in Lufthansa - 01/18/2017

UAE state-owned airline Etihad Airways does not intend to increase its share in German air carrier Lufthansa, said Head of Etihad James Hogan. According to him, Etihad is interested in strengthening partnership with Lufthansa. However, there is no question of increasing stake in the German carrier’s capital. "Etihad has made no equity investments in the German carrier" - The Wall Street Journal...

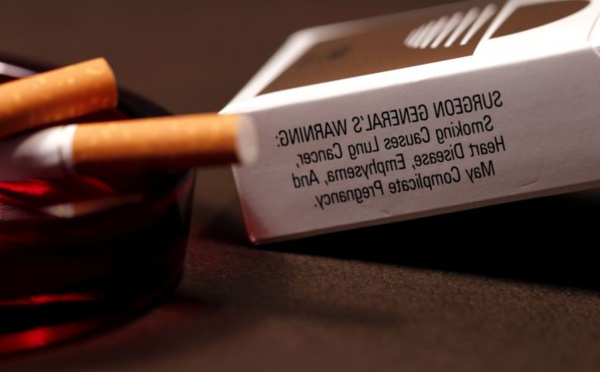

British American Tobacco to buy Reynolds American for $ 49 billion - 01/17/2017

Tobacco companies British American Tobacco (BAT) and Reynolds American approved a merger deal worth $ 49 billion. The two giants are going to create the world's largest tobacco company, which, in turn, may trigger new wave of M&As in the tobacco industry. BAT will pay $ 49 billion for 58% stake in Reynolds, which is 26% more than value of Reynolds in October 2016, when BAT first announced its...

Moody`s to pay $ 864 million for inflated mortgage ratings - 01/16/2017

The US Department of Justice and rating agency Moody`s said they reached an agreement in legal dispute. The agency will pay $ 864 million of compensation to the American authorities for incorrect assignment of rating to mortgage-backed securities in anticipation of the mortgage crisis in 2007. Inflated ratings of mortgage-backed securities were one of the main causes of the mortgage crisis,...

New possible Dieselgate brought down Renault's quotes - 01/13/2017

On Friday, 13 January, Renault’s quotes fell down 6%. France Press reported that the French regulators are launching a preliminary investigation into possible underestimation of emissions in the concern’s diesel cars. According to the agency’s source, the investigation began on January 12, led by three forensic investigators. Exactly one year ago, AFP’s message also provoked 25% slump of...

PETA becomes Givenchy's shareholder - 01/13/2017

Organization People for the Ethical Treatment of Animals, PETA, has become a minority shareholder of French luxury manufacturer LVMH Moet Hennessy Louis Vuitton SA products. This way, the organization hopes to intensify the fight against the use hides and skins of exotic animals in the fashion industry, writes the Financial Times. PETA’s decision to buy shares in LVMH resulted from investigation...