Companies & CEOs

Trump tariffs harm Apple’s market performance - 11/30/2018

Apple, whose financial performance is not pleasing investors, faced another problem: the trade war with China caused the price for iPhone to rise by 10%. At the same time, the American leader believes that buyers will “easily cope” with price increases, which means that nothing terrible will happen. Since October, Apple Inc. has lost one fifth of its value and ceased to be a trillion-dollar...

Qualcomm creates $ 100 million fund to invest in AI - 11/29/2018

The American chip maker Qualcomm Inc has created a $ 100 million fund to invest in startups working on artificial intelligence technologies, reports Reuters. The new organization will focus on AI technologies that will be used in unmanned vehicles, robotics and machine learning platforms. Qualcomm Ventures AI Fund has already invested in AnyVision startup, which is engaged in face and object...

Goldman Sachs-1MDB scandal takes new round - 11/28/2018

Last week, the Emirates sovereign fund IPIC and its subsidiary Aabar Investments sued one of the world's largest investment banks, Goldman Sachs. The latter is suspected in corruption and bribing. The funds believe that the bank has played a key role in the international corruption scandal around the Malaysian investment fund 1Malaysia Development Bhd (1MDB). According to them, several Goldman...

Amazon aims to lead US ads market - 11/28/2018

For many years, two giants - Facebook and Google – have been ruling the American digital advertising market. Now they account for 61% of the cost of advertising companies in the United States. But a fierce struggle for the third place has been going on for a long time. Now, it is clear that the winner is Amazon. Moreover, according to analysts, the online retailer should become the new online ads...

GM to lay off 15% of staff in North America - 11/27/2018

The largest US automaker General Motors Co. (GM) is planning to reduce the number of employees in North America by 15%, including reducing the number of managers by 25%, the company said in a press release. Given the current number of GM employees in the region, the layoffs will affect more than 10 thousand people. The company also plans to close four plants in the United States and one in...

Chinese CNPC replaces Total in Iranian South Pars gas project - 11/26/2018

CNPC, the Chinese state-owned oil and gas company, has replaced Total, the French energy giant, in the South Pars Iranian multi-billion gas project. This was stated by Iranian Oil Minister Bijan Zangeneh, the ICANA news agency reported. "The Chinese CNPC officially replaced Total in development of Phase 11 South Pars, but in fact it has not yet begun work. It is necessary to negotiate with CNPC...

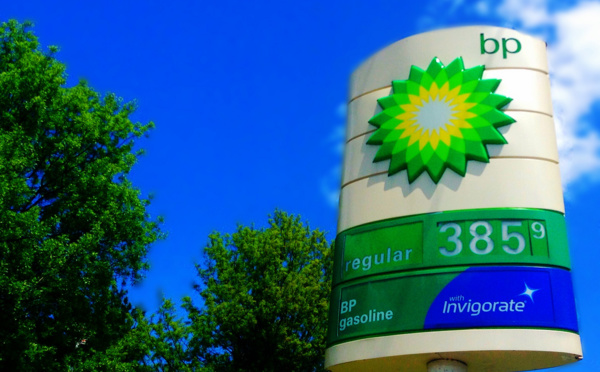

BP starts oil production at Clair Ridge in the North Sea - 11/23/2018

A consortium led by BP, a British oil and gas company, began production at the Clair Ridge project's giant oil field on the British shelf of the North Sea. "BP, together with partners Shell, Chevron and ConocoPhillips, today announced the start of oil production of the giant project Clair Ridge to the west of the Shetland region (islands) of the UK shelf," the company said. The share of BP in...

Carlos Ghosn arrested, Nissan, Mitsubishi shares collapse in the first minutes of trading - 11/20/2018

Arrest of the chairman of the board of directors Carlos Ghosn questioned the future of the alliance between Nissan and its French partner Renault. The scandal surrounding the chairman of the board of directors of Nissan, Carlos Ghosn, led to a drop in shares of the Japanese automaker at the opening of stock trading in Tokyo. In the first minutes, papers of the companies lost 6.25%, dropping to...

US shale companies to invest $ 100 million in New Mexico and Texas - 11/19/2018

Business will allocate funds to solve problems of health, education and civil infrastructure in regions experiencing a "shale boom." More than a dozen mining companies agreed to help the US states where the shale boom is taking place. According to Reuters, among them are Chevron, EOG Resources, Exxon Mobil and Royal Dutch Shell. They are part of a consortium that supports the Permian strategic...

Bank of China to set up a capital management subsidiary - 11/16/2018

Bank of China plans to invest up to 10 billion yuan ($ 1.44 billion) to launch a capital management subsidiary, reports The Paper. Following 14 small and medium-sized commercial banks that announced their intention to establish asset management subsidiaries, Bank of China was the first of the four largest state-owned banks to make this decision. The subsidiary will use Bank of China’s own funds...